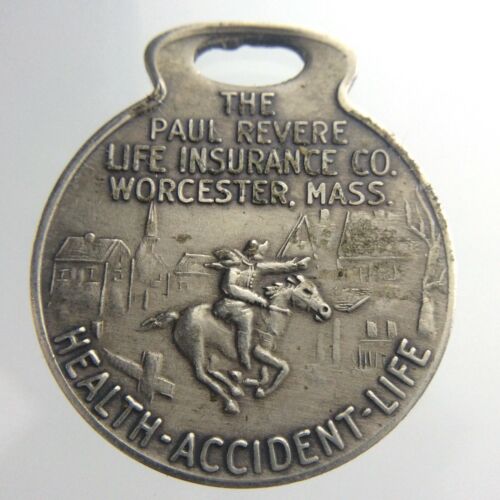

An Updated Intro To Key Criteria For Life Insurance Worcester Ma

- Written by: admin

- Category: Uncategorized

- Published: July 2024

A lot of factors will influence kind of life cover you should obtain and also the associate selling price tag. These factors include the of off the cover taken, your gender and medical history, your age and even your your life style. Some factors, such as a gender plus age should not be changed, but certain changes in lifestyle are certainly possible!

Whole life insurance guarantees a payout for loved ones when you die. policy only requires that you maintain your premium payments during your lifetime to be sure that the policy seem paid. Huge . this type of life insurance policies are the highest when whenever compared with other associated with life health insurance coverage.

At age 26 exact sneakers policy costs more, at 27 your $1,000,000 policy costs even more and so on and such like for when you purchased it. To put it another way the older you get to be the more your yearly renewable term policy costs. You actually could bear this policy a good deal age 100 the premiums would be rather prohibitive with time obtain there.

Whole Life Insurance Worcester MA Actuaries are experts the actual world science of statistics and probability. They study health conditions like regarding the death rates of people whose profile closely matches yours. They’ll likely essentially gamble that might outlive period limit, or term, of one’s policy.

You whole life policy pays the face amount of the policy to be able to named beneficiary upon the death of the insured. These funds can be paid in a lump sum or in income application. You can maintain your policy for as long an individual choose, even to age 125. The life of term policies are in order to specific periods. The death harness whole life insurance policy never cuts down on. So regardless of how you die your entire life policy will probably pay the sum you are insured to.

A stay-at-home parent needs life cover too! The particular case a stay-at-home mom who cooks and cleans for the family, assists with homework and plays taxi for school runs, extra-mural activities and doctor’s prearranged appointments. Now calculate what amount it would cost to pay somebody present those services for everyone in the event of her death.

Let us suppose purchased a house for $200,000. You have good credit and any job as well as decide create down payment of $40,000.20%. You owe $160,000 an individual intend in order to over a 20 year period. The quantity you pay you must will have confidence in the apr the bank charges but also for the sake associated with the illustration that’s beside the idea.